Smaller companies are back in fashion

Small cap firms are benefiting from Covid-19

The Covid-19 pandemic has had a huge impact on stock markets, with the initial shock in the spring giving much cause for concern for those invested.

Typically smaller companies do worse in recessions as there is less liquidity and they may not have the same financial resilience as larger companies.

But this recession is different - smaller companies can move more quickly into a new operating environment, and money is available, and cheap.

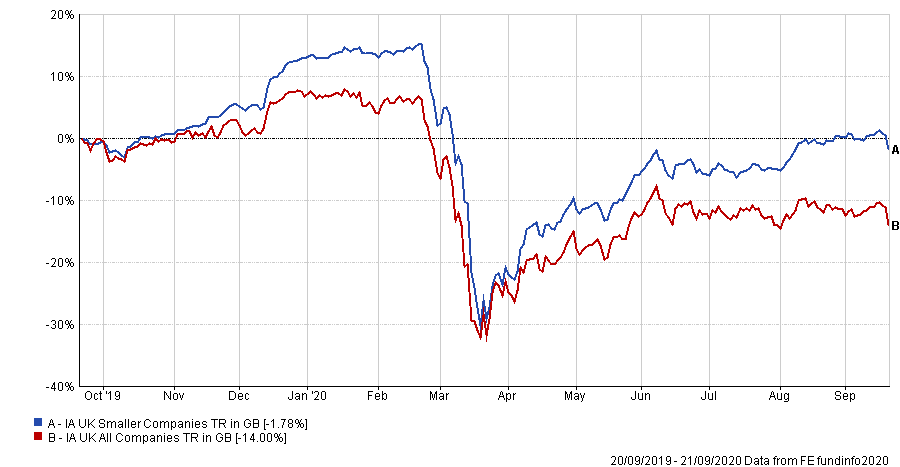

Looking at the data, the UK smaller companies sector has performed better, coming out of the initial lockdown more successfully than the UK All Companies sector.

This report looks at some of the prevailing issues affecting investments in small companies.

It is worth an indicative 30 minutes of CPD

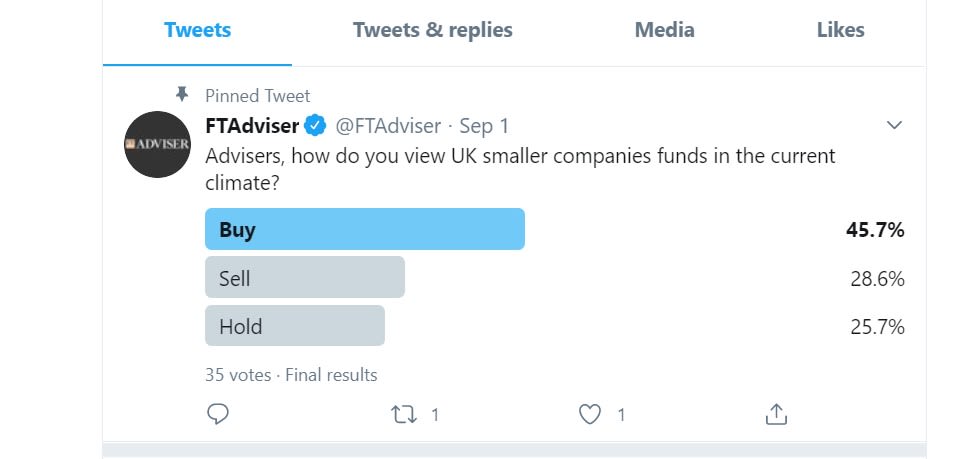

Advisers plan to boost their clients' exposure to small caps

Advisers intend to increase their client’s exposure to small cap equity funds in the year ahead, according to the latest FTAdviser poll.

The poll data shows 45.7 per cent of advisers intend to buy more small cap, 25 per cent intend to hold at the current levels, and 28 per cent intend to reduce their allocation to small caps.

Smaller company shares sold off sharply in the market crash of March 2020, but have rebounded since.

Data from FE Analytics shows funds in the IA UK Smaller Companies sector have gained 4 per cent since March, although they remain 11 per cent lower this year to date.

Dividend cuts have also been a feature of the small cap universe in much the same way they have of large cap land, with 57 per cent of small and mid cap stocks reducing dividends, compared to 50 per cent of companies in the FTSE 100

Tom Sparke, investment manager at GDIM, a discretionary fund management firm in Cambridge said: “We have almost always had some UK small cap funds in portfolios, until recently.

“At one stage our UK weighting was so low that we had no small caps in there. Our weighting is still very low but we do have one small companies fund now which is Chelverton, as the fund has a lot of quality companies in it.”

Minesh Patel, an adviser at EA Financial Solutions said: “This would seem to be a good time to buy smaller companies funds, as they are priced quite cheaply.”

Covid-19 has created opportunities for small cap stocks

It is, says Guy Anderson, different this time for smaller companies listed on the London Stock Exchange.

Mr Anderson runs the £1.9bn Mercantile investment trust, which invests predominantly in UK mid and small cap companies.

He said: “Typically in a recession, smaller companies perform much worse, because there is less liquidity in the system, and because investors view them as higher risk.

“And in March, smaller companies did indeed sell-off with the rest of the market, but since then they have bounced back very strongly.

“Smaller companies have been able to raise fresh capital, which might not have happened on previous occasions. A lot of that is because of the extra liquidity in the system.”

Trevor Green, UK equity fund manager at Aviva Investors says: “I think the market understands why companies need to raise money now, why companies' profits are lower, they know it is not the fault of management, so companies trying to raise cash have been able to do it quite easily on the UK market, which is not always the case during a recession.”

In typical recessionary condition, banks are reluctant to lend, or will only do so at much higher rates of interest.

At the same time, investors, pessimistic about the prospects for the economy and the wider market, place their capital into stocks which have defensive characteristics and a greater level of predictability about the level of cash the business can generate.

This reduces the level of liquidity in the market, making it much harder for firms to raise capital, either via the issuing of new shares on the stock market, or through debt.

But the Bank of England’s policy of quantitative easing, combined with its cut to interest rates, means there is more liquidity in the system than had previously been the case.

But Ian Forrest, UK equity analyst at the Share Centre sees it differently.

He says: “The problem is that smaller companies generally struggle when large caps are cheap, and in the UK right now, large caps are cheap. This means big investors are looking at the large caps as attractive, and more robust, and so better value right now.”

Jonathan Winton, who runs the Fidelity UK Smaller Companies fund, says that while the valuations of some parts of the smaller companies universe, such as technology stocks have risen sharply, some businesses, in areas such as retail and leisure, have not recovered all of their value and so he sees much better value there, despite the uncertainty plaguing the sector.

He favours investments in the latter sector right now.

March stock market collapse

The market collapse in March was atypical; companies share prices fell, not simply because of short-term concerns around the performance of the economy, but also because of societal changes which may be afoot that will have profound, long-term impacts on their business models.

The typical recessionary market sees investors exit small caps and instead invest in companies they believe have greater durability and predictability.

But changes to the way people and companies live, work and consume, have also influenced the markets performance since March, with businesses, whether large or small cap, perceived to be likely to lose out from these changes being treated more harshly by the market, whatever their size.

This has meant some of the traditional safe haven stocks, such as big oil companies, have fallen sharply from favour, challenging traditional assumptions about equities in a recession.

The rise of China

One major change to the global economy which has been accelerated by the pandemic is the rise of the Chinese economy.

From the end of the second world war until the aftermath of the global financial crisis in 2008, the US was what economists call the “marginal buyer” in the world economy; what this meant was that, the performance of the US dictated to a large extent the performance of the rest of the global economy.

But for the past decade, it has been the performance of the Chinese economy that has played this role.

The Chinese economy has rebounded sharply since March, boosting the global economy.

This matters to smaller company funds, according to Octopus equity fund manager Chris McVey, as many of the smaller companies on the London Stock Exchange are exporters, including to China.

UK opportunities

He cited Strix, a business which manufactures components for kettles, as an example of a UK smaller company that is more exposed to China, and so relatively immune from the challenges of the rest of the world.

Richard Penny, who runs the Crux UK Special Situations fund, says the opportunity in UK smaller companies stems from the “perception” and “image” of the UK market right now, a perception partly about Brexit, and an image that the UK market has a dearth of technology companies, and a plethora of the sort of companies that will lose out as a result of the changes.

But Mr Penny says: “The reality is that while there is a lack of tech giants such as Amazon, in the next generation of technologies there are companies in the UK at just the same stage of development as those in the US, working on the same technologies, but the UK ones are at much cheaper valuations, because of how the UK market is perceived.”

Among the stocks he owns which he believes are well placed to profit from societal changes are IP Group.

It isn’t any more the case that a firm just has to have a website, it is about knowing your customer, about what they want

Mr Green says: “If you look at one of the secular changes, the rise of online shopping, there are companies listed on the UK market that work with Tesco and Heineken for example, to enable their e-commerce offering.

“It isn’t any more the case that a firm just has to have a website, it is about knowing your customer, about what they want, and there are UK companies which are key to that.”

Mr Forrest says: “While there are likely to be changes it is hard to know at this stage exactly what the changes will look like, and which ones will be long-term.”

Alex Harvey, portfolio manager at Momentum Global Investment Management says: “The coming years are likely to see one of the biggest shifts in lifestyle and working practices in decades. Covid-19 was the catalyst for this change but the technology to facilitate it, as we’re all now aware, has been around for some time.

“It’s just that we’ve been forced to adopt it more quickly, and concurrently. This is likely to be a multi-year adjustment period and will be more evolution than revolution.

“That means there will be opportunities to fill new gaps and provide services in the future which may be unserved, or not be required, today. Smaller companies by their nature should be better served to cater for these evolving needs and trends.

There will be opportunities to fill new gaps and provide services in the future which may be unserved, or not be required, today

“They may be able to adapt workforces or manufacturing techniques more quickly and offer more bespoke customer service. The scalability afforded by modern technology means the more asset-lite service sector cohort of small companies can grow their earnings rapidly which ultimately should help share prices higher.”

Jonathan Brown, smaller companies fund manager at Invesco, believes the opportunity in the market right now is to buy some of the companies in traditional areas of the economy which have fallen the farthest.

He says: “Some things will go back to normal, or much closer to normal, and at this time, the market is not pricing that in. This means some of the best opportunities are in those companies which have fallen the most, such as companies in the leisure and retail sector.”

The dividend dilemma

One consequence of the market dislocations of 2020 has been the swathe of companies in the FTSE 100, such as Shell, which have cut or cancelled dividends, having previously been stalwarts of many clients' portfolios.

But the problems have not been confined to large cap land, with Mr Winton saying that 59 per cent of dividends have been cut in the smaller companies sector, while the cuts have been “only” 50 per cent among FTSE 100 companies.

Robin Geffen, fund manager and head of the global equity team at Liontrust says that he is sticking with large caps for income, as he expects companies in sectors such as technology to become bigger dividend payers, while he remains cautious on the outlook for companies that are typically smaller in size, such as hospitality, to struggle for the long-term.

But Ken Wooton, who runs the Gresham House multi-cap income fund is more positive on the dividend potential of small caps.

He says: “It has been apparent for some time that there was a significant concentration risk for investors seeking income from UK dividend paying stocks, with the majority of UK dividends coming from just a handful of FTSE 100 large cap companies concentrated in a few sectors.

“This risk has played out acutely during the first half of 2020 as sectors such as banks suspended dividends under political pressure and oil companies such as Royal Dutch Shell and BP responded to a rapidly falling oil price with large dividend cuts.

Lower levels of debt have made many smaller companies more resilient, enabling them to continue to pay attractive dividends even in more challenging times

“For those who have been able to look beyond the FTSE 100 to smaller companies the picture has been much better. Some sectors, particularly consumer, have been temporarily impacted by lockdowns regardless of the size of the company and have had to preserve cash in the short term.

“However, lower levels of debt and often niche market positioning have made many smaller companies more resilient, enabling them to continue to pay attractive dividends even in more challenging times. Others will bounce back faster than their larger peers for similar reasons.”

Mr Winton is similarly positive, he says: “The problem with large caps is that some of the companies that have cut dividends are structurally challenged.

“Covid has brought forward a long-term problem for companies such as BP and Shell. In contrast, the smaller companies that have cut dividends have done so as a result of Covid, and there are already signs that dividends are coming back.”

Dividend cover

Mr McVey believes the numbers back up this positivity. He says the average dividend outside of the FTSE 100 is “covered” three times over, while the average in the FTSE 100 is only covered 1.5 times.

Dividend cover means the extent to which a business is generating enough new income every year to pay the dividend. Companies can either pay through the cash they generate, or, as some large caps have, via issuing debt.

Dividend cover of 1.5 times, means a company is generating one-and-a-half times the amount of cash it needs to pay out a dividend. This is the minimum level the market looks for in order for a dividend to be regarded as safe.

david.thorpe@ft.com

House view: small caps offer opportunities

Small capitalisation stocks, or small caps, can offer the potential for higher returns compared with investing in larger companies, although they are not without risks.

As with all equities, investors may not get back the amount they originally invested.

As well as the potential for higher returns, investors are also being drawn to the sector for another reason – the ability to navigate the increasingly disruptive environment in which we live.

Larger, older and more cumbersome companies are not always best equipped to adapt to rapid change.

Small caps, in contrast, can be more nimble and are often the driving force behind disruption, benefitting from the trend, rather than being a victim of it.

Small companies, operating in relatively large and mature markets, also have the capacity to grow disproportionately from a low revenue and profits base.

Moreover, it is often only by investing in small companies that investors can gain exposure to a new technology or a market.

The disruptive power of small caps

The world is changing fast. Old industries are under considerable pressure with innovation and technological advances moving at an unprecedented pace.

New competitors with superior technology can quickly displace established companies that have dominated their sector for decades.

The relentless growth of online retailer Amazon and the decline of US shopping malls clearly demonstrates this trend.

Although not immune to it, small-cap companies can benefit from this disruption.

They are less burdened with layers of management and there is less fear of losing sales volume or market share by introducing new products, a major issue for well-established large corporations.

The following examples illustrate how some smaller companies have taken advantage of their size to adapt to disruptive market forces.

Responsive to changing demand - Musashi Seimitsu

Japanese auto parts maker Musashi Seimitsu demonstrates why being nimble in the face of changing demand is critical when facing disruption.

The company revamped its product offering by developing parts to be used in electric motors.

This followed the realisation that the shift to electric vehicles could lead to reduced demand for its transmission and engine products (because electric cars require fewer parts than internal combustion engine vehicles).

Consequently, when electric vehicles become more prevalent, it should be able to respond quickly to the changing demand by ramping up the production of electric vehicle parts.

Flexible producer - Albioma

French independent renewable energy supplier Albioma operates in French oversees territories and a few developing countries.

It has a long-term supply contract with EDF (France’s state-owned electricity company) to provide electricity in several of those territories.

Albioma’s power plants are designed to operate on a variety of fuels.

This could stand it in good stead following President Macron’s announcement that France will cease to use coal to produce electricity after 2022, with a push to replace it with biomass (organic material used as fuel).

The flexibility of the company’s plants means that the change in energy source will require less capital expenditure than large power companies will be burdened with when they convert their coal-fired plants.

Reinvented as an enabler of disruption - Chroma

Just as pick and shovel sellers, rather than gold miners, were the ones who made fortunes in California’s 19th century gold rush, companies can also be enablers of disruption, rather than producers of disruptive products.

Taiwanese electronic testing and measurement equipment manufacturer Chroma ATE used to produce testing equipment for traditional power electronics.

However, as new technologies have emerged, it has substantially reinvented itself.

Over the past 10 years, it has started making testers for wireless solution, LED lighting and semiconductor companies.

In the last three years, electric vehicles have become the key driver of its growth and the company now sells testing machines to the largest global electric vehicle battery producers.

It also enables facial recognition technology on smartphones by selling testers to companies in both the Apple and Android supply chains.

Spread the risk

Although the small-cap sector is large and varied, smaller companies have a higher degree of specific risks at an individual stock level.

Dependency on one product or market, a small number of key executives, higher representation in cyclical sectors and typically more limited options for financing are some of the key risks for small companies.

Diversification is one way to mitigate these stock-specific risks, as is a thorough understanding of the strengths, risks and vulnerabilities of individual companies.

Kristjan Mee is a strategist, research and analytics and Matthew Dobbs is global head of small cap at Schroders

Any references to securities are for illustrative purposes only and not a recommendation to buy and/or sell.